Global real estate leader JLL has revealed a surge in Maldives’ property transactions, reaching an impressive USD 1.9 billion, as detailed in the Maldives Hotel Investment Guide recently published by JLL. This revelation solidifies the Maldives’ status as the foremost resort business destination on a global scale.

The Maldives has consistently been the highest-rated market in the Indian Ocean, with overall trading performance driven by impressive growth in average daily rate (ADR). During the pandemic, the Maldives experienced a strong surge (40% y-o-y) in market-wide ADR in 2020 due to the scarcity of travel destinations open at the time.

Despite the market adjusting and normalising as competing markets opened up, market-wide revenue per available room (RevPAR) in the Maldives in 2022 was still at a 10% premium above 2019 level. With the return of the Chinese market, as well as other Asian markets in 2023, market-wide occupancy is expected to improve during the low season, which will help mitigate falls in ADR as the market continues to normalise for the rest of the year.

With the evolution of the Maldives tourism industry, driven by sales of islands and lagoons by the Government, resort supply has grown by approximately 5% annually between 2009 and 2022. However, future supply in the next two years is expected to taper off, with total new supply accounting for 7% of total existing supply.

Majority of the new hotels are opening in 2023 with the upscale segment representing around 54% of total future supply. Nonetheless, its anticipated some openings to be delayed due to added time required for land reclamation projects, supply chain issues and rising interest rates.

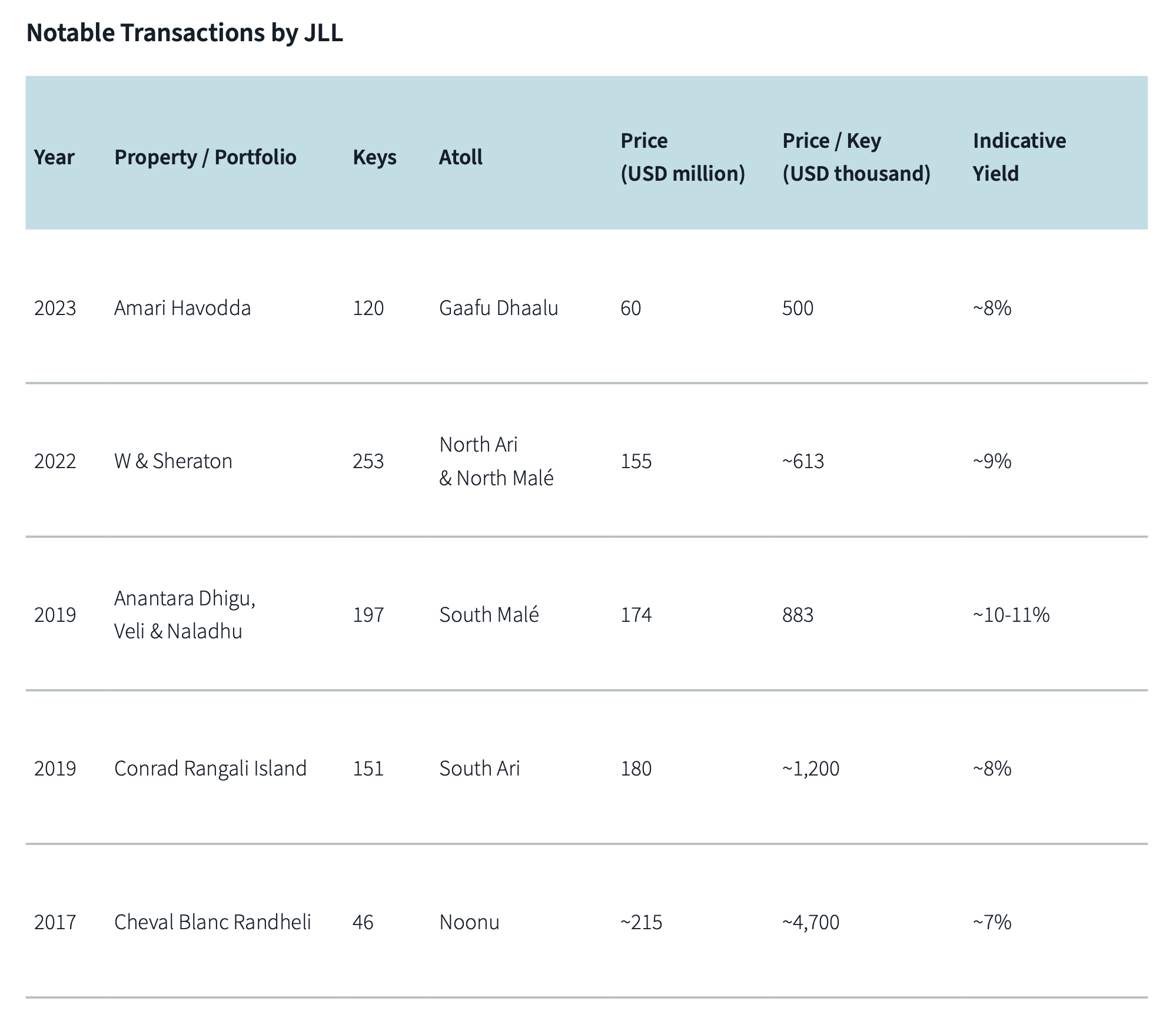

Since 2012, the Maldives has witnessed a significant amount of completed hotel transactions, surpassing USD 1.9 billion as of September 2023. On average, there have been three transactions per year in the market during this period at an average price per key of USD 807,000. One notable transaction was the sale of Cheval Blanc Randheli in 2017, which set a global record for one of the highest prices per key.

JLL, a prominent real estate and investment management firm, has been involved in several notable transactions in the past decade, showcasing their expertise and influence in the industry. These transactions have contributed significantly to the company’s growth, with an approximate increase of 8% to 11% in their overall market share, making them a reliable choice for investors seeking expertise in the real estate domain.