Key Findings

• Total tourist arrivals to reach 2.5 million by 2023

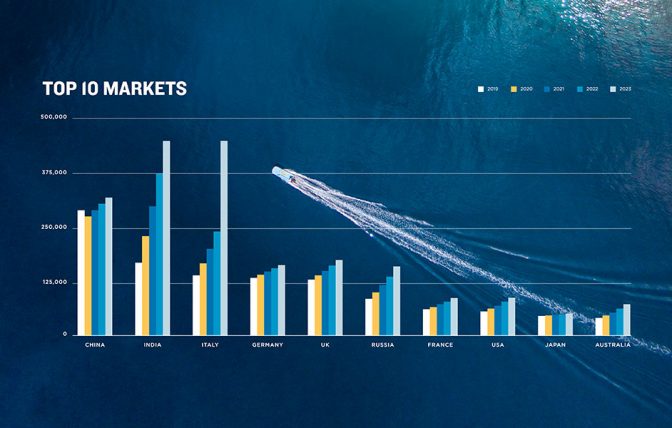

• Indian market to overtake Chinese market by 2021

• Indian and Chinese market to have 30% market share by 2023

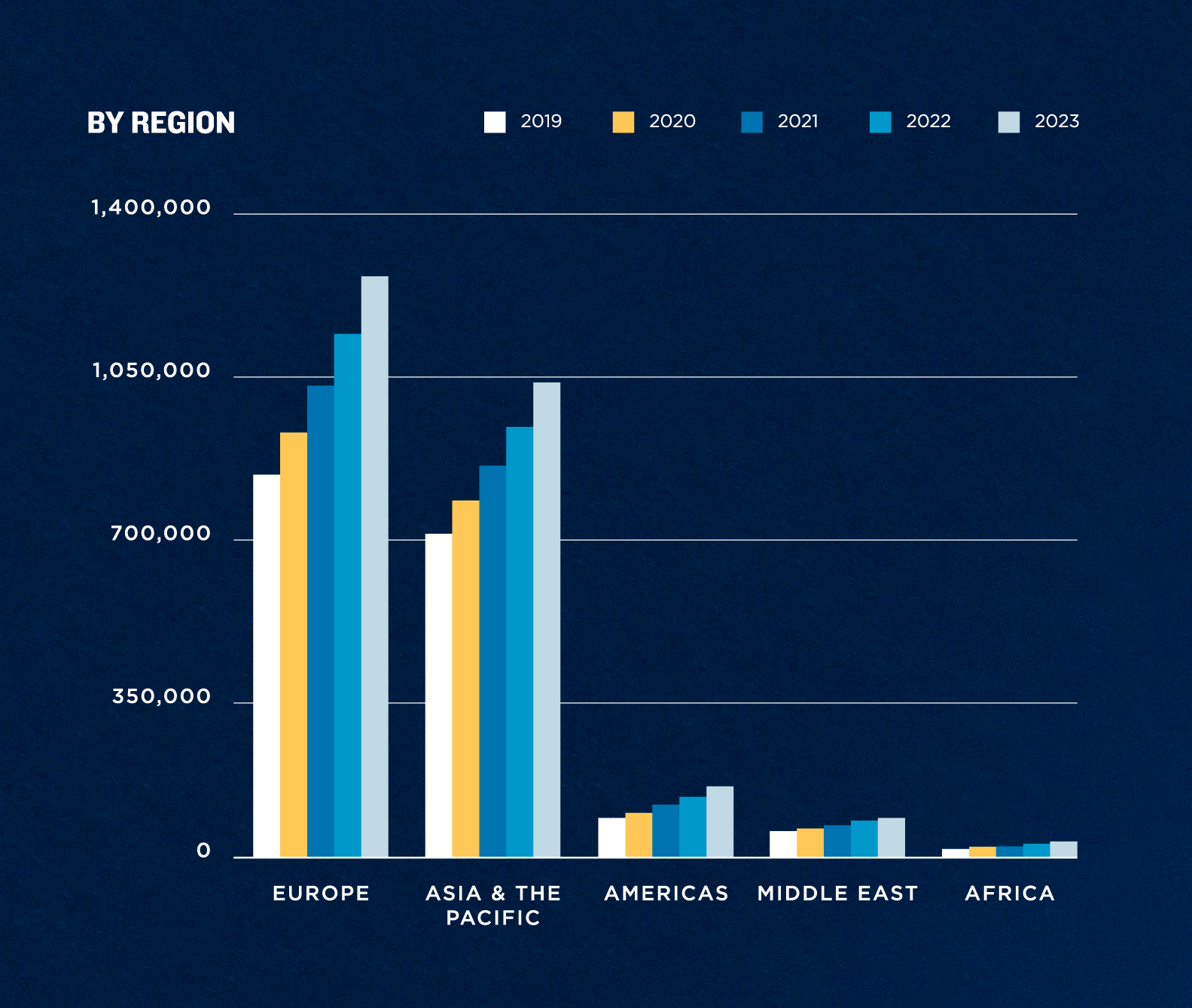

• Europe to remain the largest market by region

• Average Daily Rate and Average Stay to fall with increase in Asian markets

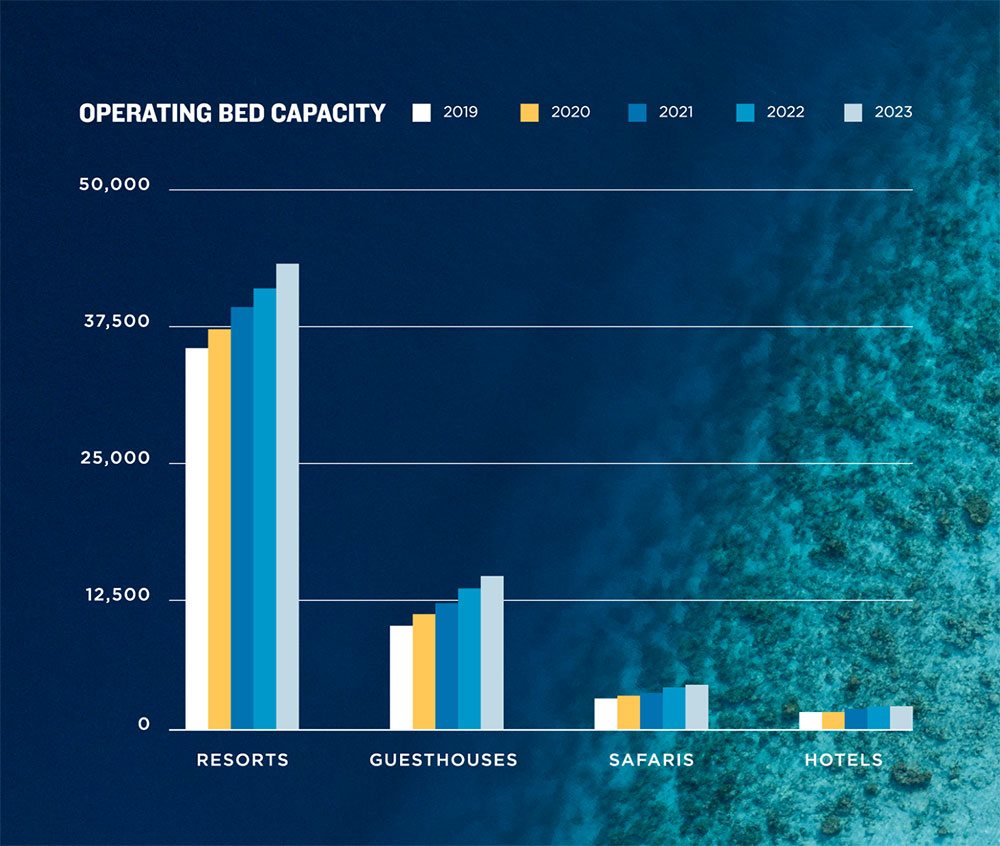

• Operating bed capacity to increase by average 8%

Tourism industry is the largest economic industry in the Maldives. It plays a significant role in contributing towards the economic growth, earning foreign exchanges and creates employment opportunities in the tertiary sector.

Our team at TTM decided to look into a brief overview into the Maldives tourism industry for the year 2019, including the key markets and the highlights along with the future forecast of the demand and supply of the industry for the next 4 years.

Current Status

According to the statistics by the Ministry of Tourism, 2019 proved to be one of the most successful years with reaching target of 1.5 millionth tourist arrival on November 24th, Maldives welcomed a record amount of 1,702,831 tourists. This was a 14.7% increase compared to 2018.

After slowing in 2018, tourist arrivals rebounded during the first half of 2019 and continued to do so throughout the year. Europe has been the strongest region for the Maldives for the past few years and even in 2019.

In 2019 tourist arrivals from Europe (49%) was with a 14.8% increase and 833,904 tourists. The second strongest performance was from Asia and the Pacific (41.4%). There were 705,117 tourists from this region in the year. This is a 13.5% increase compared to 2018. This was followed by American countries (5%) with 84,793 tourists, Middle East (3.5%) with 60,003 tourists and Africa with 18, 698 tourists.

Looking at the top 10 country-wise markets, though China market has continued to be in the top, after no increase in the growth for the past 3 years, the market had a 0.3% increase in 2019.

Indian market, which was at 5th place in 2018 with 66,955 tourists, jumped to the 2nd position with a whopping 166,030 tourist arrivals in 2019 and India showed the highest growth rate with 83.5% in 2019.

India is now one of the fastest growing outbound tourism markets in the world, second only to China. The United Nations World Tourism Organization (UNWTO) estimates that India will account for 50 million outbound tourists by 2020.

Maldives being geographically closer to the Indian market contributes to this growth. In addition to this, the emergence of more airlines and routes has increased the availability of options for the Indian travelers.

Indian budget carriers such as GoAir, Spice Jet and Indigo have launched direct connections between Male and important Indian cities such as New Delhi, Bangalore and Mumbai.

The Germany and USA market also continued to show increase as the previous years while other markets Italy, UK, Russia, France, Japan and Australia showed a steady increase.

Looking into the supply, with over 20 new resorts opened in 2019, there were 927 tourist centres registered by the end of 2019. Traditionally, the tourist centres mainly compromised of the resorts, however with the emergence of local island tourism in 2017, guesthouses have opened new options for even the budget travelers. Every year Maldives has witness over 1000 new operating bed capacity from guesthouses itself.

By the end of 2019, the tourist centres include 152 resorts, 12 hotels, 607 guesthouses and 156 safaris. All this combined gave an accumulated operating bed capacity of 49, 924. This was a 13.9% growth in the operating bed capacity for 2019 compared to 2018.

Future Forecast

The government has aimed to set new target of 2.5 million annual arrivals by 2023.

As per the past growth trends of the markets, Maldives is expected to welcome 1.8 million tourists in 2020, reaching 2.5 million tourists by 2023.

According to the forecast, if the slow growth of Chinese market continues, while the Indian market continues to grow, Indian will surpass the Chinese market to become the largest market for Maldives tourism industry.

As per the market growth by region, Europe market will remain the top market but the Asia and the Pacific market will keep increasing as well.

The American market and African is expected to increase almost a double by the end of 2023.

As per the supply, the government has announced that tourism sector will increase 1,300 beds in 2020 with 13 new resorts and 74 guesthouses.

Maldives will need the operating bed capacity to be at 53,078 by 2020 to generate 70% bed night occupancy of 13 million. This will require 2.2 million tourists on an average of 6 nights. However as per the forecast, by end of 2020 Maldives is expected for 11 million actual bed nights with occupancy at 61%.

By the end of 2023, with 63,937 operating bed capacity, for 70% bed night occupancy, Maldives requires 16 million bed nights. This will require 2.7 million tourists on an average stay of 6 nights. But, according to the forecast, by end of 2023 Maldives is expected receive 15 million bed nights with an average occupancy at 67%.

But the worrying factor is the with the ever-growing Asian market, the average stays could be lower and thus resulting in much lower bed nights even with an increase in total tourist arrivals. Since ADR is lower for Indian and Chinese markets, another concerning factor is that this could reduce the average ADR considerably since these markets will account to over 30% of the total tourist arrivals to the Maldives by 2023.

Conclusions – Recommendations

It’s important to have more European connectivity focused on our traditional European markets if we want to maintain a better average stay and ADR. Thus, with fewer arrivals’ figures can provide better over tourism receipts. Aviation industry policies of Maldives must align with tourism marketing policies by focusing on key European markets. Either by giving incentives to fly to Maldives or bilateral government talks can help to boost the routes from Europe to Maldives. It’s important to identify top 15 markets for long-term and focus on air connectivity to these to ensure that expected arrival figures are met.